Hello together,

With attention I read freaky 'Vincent' finance rather restrained blog entry in which he tells us that he is a millionaire.

At this point congratulations from me ! Honestly. Great performance. Respect.

And while I really envy Vincent on the one hand, besides the million, also about his great ideas with what you can make all the money, I wonder if this level of wealth is just for the privileged "technician at the DAX Group" or for anyone with enough discipline. and willingness to save is possible.

To do this, I did a few sample calculations and created the ultimate checklist from them.

All names are fictitious and similarities to living or dead persons are purely coincidental. Have fun.

Our calculations begin with the fictitious start of savings in 2000.

- Taxes are charged at a flat rate of 26.375%. The new situation with an advance flat rate is not taken into account in this model.

- Also otherwise the calculations are greatly simplified and I do not recommend to anyone to invest all their assets in shares !

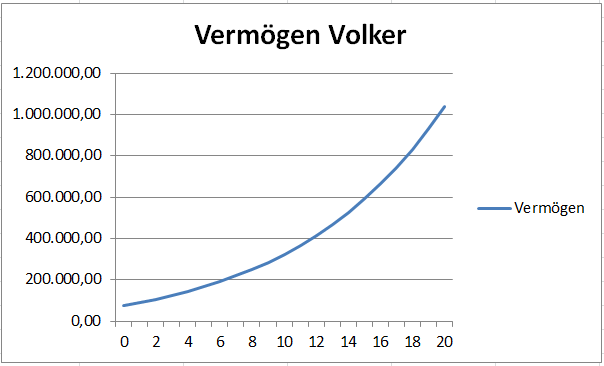

Case 1: Volker Loss Carryforward – Technician at the DAX Group

Volker trained and, at the age of 20, entered as the average earner in 2000. As he does a great job, continues to train and raises new sources of income, his income rises neatly every year.

Volker is also a hard-hitting saver, putting aside 60% every month.

Volker's parents gave him the 18th anniversary of his birth as a starting capital. birthday instead of car a savings book with 75000€ as a gift.

As a financial expert, he manages to increase his savings by an average of 6% each year.

Key data Volker

- Start-up capital: 50000€

- Net income in 2000: 1500€ / month

- Savings rate: 60%

- Revenue dynamics: 9.5% p.a.

- Return on savings: 6% p.a.

Result after 20 years: Volker is a millionaire after tax. Congratulations.

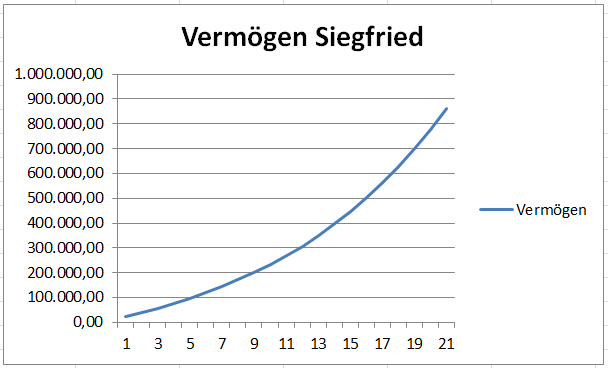

Case 2: Siegfried Sparstrumpf – Seller at EDEKA

Siegfried has also trained and enters the job at the age of 20. In addition to a permanent job, the salary increases are also quite fixed and there are hardly any opportunities for promotion.

But what Siegfried does away by consistently renouncing all unnecessary things. Siegfried thus manages to set aside 75% of his income.

Since Siegfried has already saved a lot during school and studies, his starting capital is €25,000.

Siegfried reads too many financial blogs and consistently saves an MSCI-World ETF. This allows him to achieve an average return of 7.5%.

Key data Siegfried

- Start-up capital: 25000€

- Net income in 2000: 1500€ / month

- Savings rate: 75%

- Revenue dynamics: 5.0% p.a.

- Return on savings: 7.5% p.a.

Result after 20 years: Siegfried is also a millionaire. But only before taxes. After that, he only has 850,000€ left.

The good news: Siegfried only has to live in asceticism for another 2 years, then he also cracked the million.

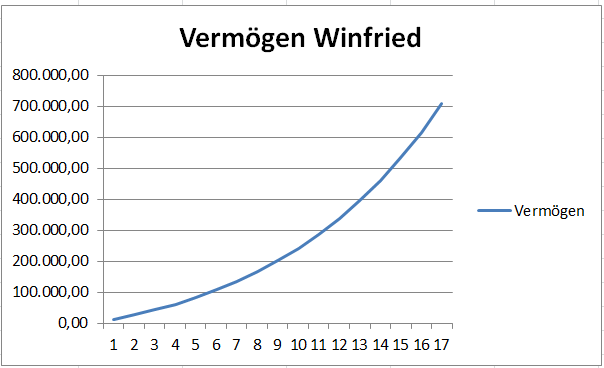

Case 3: Winfried Würstchen – Engineer

Winfried comes from a poor family, but has consistently pursued his goal of becoming a millionaire ever since. He finishes his studies at the age of 23 and comes into the job with a decent starting salary. There is also a decent salary increase every year.

Winfried saves 50% of his income, the rest goes on issues of various stock exchange magazines.

The BaföG does not have to pay Winfried back thanks to a good degree, but he also has no savings at his disposal.

Winfried manages to achieve an average return of 7.0% despite consistently buying all the shares recommended in the "shareholder".

Key data Winfried

- Start-up capital: 0€

- Net income in 2003: 2000€ / month

- Savings rate: 50%

- Revenue dynamics: 10.0% p.a.

- Return on savings: 7.0%

Result after 17 years: Good result, but unfortunately not. Winfried lacks both time and discipline. Despite the highest income, Winfried only manages to get to €700,000 after taxes.

But Winfried can also become a millionaire, he only has to wait 3 years.

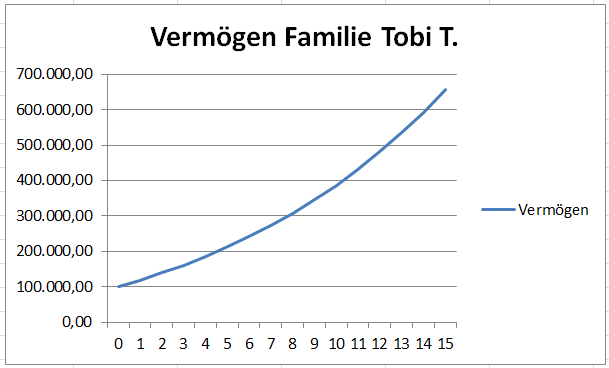

Case 4: Family Tobi T. – Something with computers

Tobi only manages to get a foothold in the job at the age of 25. Since then, however, he has earned quite well. His wife is also working, but has lost a similar amount of time raising children. With child benefit, the two come to 3500€ per month.

The two have already made a mighty effort to set aside 30% of the family income.

However, both have inherited something for this, so they enter the race with a decent start capital.

Tobi and his wife have also followed the MSCI World Mantra, with a return of 7.5% per year.

Key data Family Tobi T.

- Start-up capital: 100000€

- Net income in 2005: 3500 € / month

- Savings rate: 30%

- Revenue dynamics: 5.0% p.a.

- Return on savings: 7.5%

Result after 15 years: Last place, again due to lack of time and savings rate. For each person we get here just 325.000 €.

It will probably take until the mid-50s until each of the two millionaires here. It's pointless to put something away at all.

Conclusion

As a result of this insanely elaborate and beautifully illustrated research I present you the (*drum swirl*):

"How to become a 40 millionaire" checklist:

Must criteria:

- if possible have a completed training at the age of 20 and start working

- as a savings rate, at least 60% should be targeted, gladly more

- an income close to the average income is mandatory

- Choose a company with promotion and promotion opportunities

- a great stock market phase in hindsight, such as the period 1999 – 2019 and invest in equities as much as possible during this time.

Optional:

- no children as these downtimes are bad for your cash flow

- Start-up capital does not harm, but it is negligible for 20 years. Exception: You inherit a million.

Now, as a 39-year-old, you may rightly say: this is damn unrealistic.

So that each of you has the chance here another slimmed-down version:

"How to Get Up to 40 Millionaire" Checklist (Lite Version):

Optional:

- At some point start working when your studies are finished so at 30 approx. but hey: No stress !

- There is nothing to put away from the BaföG. So leave it and spend it on beer and concert tickets.

- it's important to start with a temporary labor slave company for the minimum wage and do the same for 30 years.

- Applying for better conditions is exhausting and you have to constantly get used to it

- Money is best invested in deposit.

Must criterion:

- Hope for hyperinflation.

All the best on your way, with greetings to Vincent and see you next time.

Comment (2)

2fallacy| September 2, 2022

2surgeon

1loudness| January 25, 2023

2predicated