Hello together,

in this loose series, I would like to take a look with you at current bonds new issues for various bond types.

If you are looking for basic information about bonds, you should read about part 1 of my bond information. If you are more interested in bond ETFs and the advantages and disadvantages of bonds and equities, this contribution is of relevance to you.

As always, these are not recommendations for the installation. Investments in bonds can end in total loss.

Why Bonds

Bonds have some advantages to equities. First of all, most bonds have a fixed maturity and fixed interest rates. This means that you already know at the beginning of the investment what profit you can expect (if the bond does not fail).

A bond can therefore be an alternative to the savings book or daily money account if everything goes well.

However, the risk for bonds is generally lower than for equities, as there is still a chance that the issuer will be paid out of the debtor's insolvency assets. As a shareholder, you usually run out of steam.

Buy bonds directly instead of scattering assets in bond ETFs

Compared to bond ETFs, one can choose as a private individual special bonds (with sometimes also low issue volume) which a bond ETF is not allowed to buy at all due to this and thus perhaps a higher yield than with the forest and meadows bond ETFs.

In addition, there are no other costs other than the trading costs of direct purchase of a bond.

However, in most other respects (risk, volatility), a bond ETF performs better. In this respect, for me, the only option for direct purchase of a bond would always be to invest in a targeted manner with smaller amounts.

Criteria

The bonds are rated by me on a scale of 0 – 10 according to the following criteria:

Yield – Comparative benchmark here are federal bonds of similar maturity. These receive 0 points due to negative interest rates. If the bond offers more, there is one point per percentage point.

Security – This is in addition to a existing rating, in particular according to the ownership structure and the prospects that the bond will also be repaid

Transparency – there are minus points for convertible bonds, subordinated bonds, adverse termination dates and other adverse provisions.

So maximum is 30 points. The rating is purely subjective and should only give a first indication. Please think about a plant yourself, read the brochures and be aware of the risk.

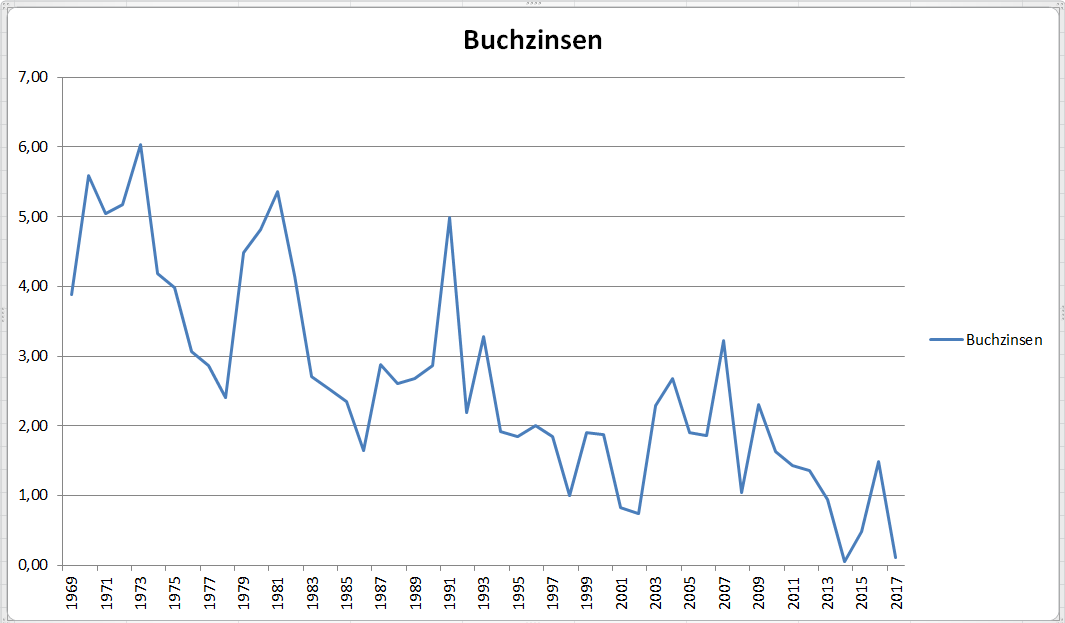

Book interest rates on savings deposits with banks are currently close to 0. It is obvious that some people are looking for alternatives.

Selected bonds New issues in August and September 2019

Landesbank Hessen-Thueringen Girozentrale-Bond: 1,500% to 23.08.2034 (DE000HLB34Z1)

Yield: 1 /10

Safety: 9 / 10

Traps: 3 / 10

Landesbank Hessen-Thüringen has a better reputation than LBBW or NordLB and the interest rate looks attractive for the time being. Until you look into the fine print.

The coupons up to 2024 are fixed at 1.5%, after which the coupon is 200% * price of the underlying (maximum 2%). As interest rates rise, the yield is expected to deteriorate over the next 10 years. If it goes in the other direction, one reserves the right to cancel the bond every year.

All in all: 13 / 30 points.

UniCredit Bank Bond: 1.750% to 01.09.2020 (DE000HVB3N39)

Yield: 2 / 10

Safety: 6 / 10

Traps: 9 / 10

UniCredit is considered a "systemically important" bank and must therefore meet special requirements. In an emergency, it will hopefully be saved by the state.

However, there are deductions in the denomination in USD, after all, this is still an uncertainty that you get on board.

The high interest rate with a short term speaks for the bond.

All in all: 17 / 30 points.

Olympic Village B 31 bond: 12,000% to 09.08.2022 (DE000A2YNXT9)

Yield: 10/10

Safety: 1 / 10

Traps: 5 / 10

A delicacy, emission volume only 3 million. The company wants to convert the Olympic village from 1936 near Berlin into residential buildings. Whether and how this works is in the stars. In any event, the land does not appear to belong to the issuer.

The whole thing has something of crowdfunding for me. However, if you find a more suitable investor or sell enough apartments, the bond can be cancelled by the end of the year. Then you were unlucky.

Definitely just something for the risk-taking investor!

All in all: 16 / 30 points.

[the_ad id=”1996″]

Do you currently have bonds in the depot ? Write me a comment.

You liked the post ? Recommend me via Facebook or Twitter. Thank you in advance 🙂

Also take a look at my other projects: the charity depot and the self-test warrants.