Hello together,

in this self-experiment I would like to find out whether warrants can be an alternative to lottery playing for stock-exchange-savvy contemporaries like me. All key data for the experiment can be found in part 1 of this series.

After the profit realization of almost 40% of the last trade, the stock market rocked quite back and forth. I couldn't find a new candidate. But now I think I've found one and this time I'm going all-in.

First of all: This self-test does not claim to be complete. While I suspect that capital will tend to be close to 0, similar to lottery games, a win can of course occur.

This is then not representative.

I advise beginners not to buy derivatives of any kind, which are usually not secured against a default of the issuing bank.

Note: In the case of derivatives, the bank usually wins. Possible purchases from me are not a recommendation.

Suggestions

Since the last trade, I have received a few suggestions for improvement. Among other things, I could of course take warrants with higher leverage or shorter maturities. I am very grateful for these suggestions.

While this naturally creates higher profit opportunities, the loss is correspondingly more likely. I actually feel quite comfortable with the current chance/risk ratio and will not change anything about it for the time being, but I do not rule it out for the future.

The underlying

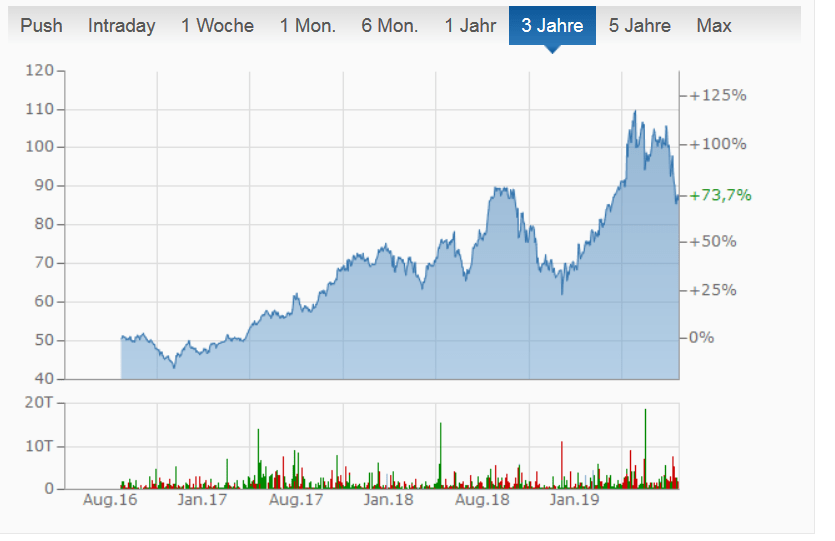

I chose Trade 2 as the underlying value of the bechtle AG share.

With 10,000 employees, Bechtle is the largest IT system house in Germany. In addition to the ever-increasing demand for IT services, this sector is also benefiting from the growing shortage of skilled workers.

Bechtle's customers are primarily large companies and the public service.

Since consulting and IT services are high-margin areas, I see good prospects for the future.

The share price fell by 20% for the first time after a new all-time high in May, which was an overdue correction. However, I am confident that the old course can be reached again soon.

The appropriate warrant

In my view, reaching a stock market value of €100 within a year is realistic.

The derivatives finder from OnVista suggests a suitable warrant for me again.

This time a call with base price of 80.00 € which runs until 16.12.20. (ISIN: DE000HZ0F4F2)

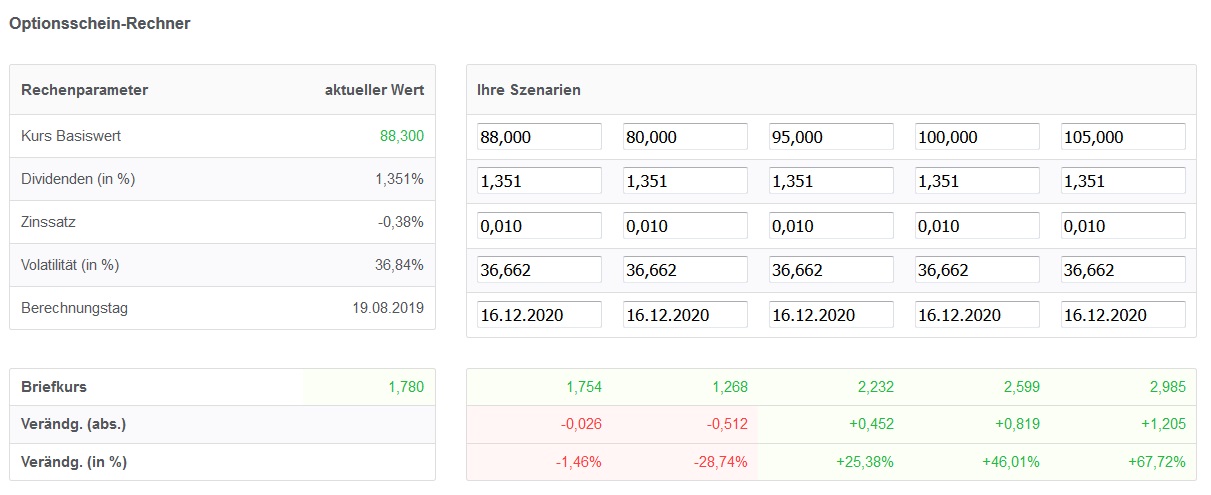

Using The Onvista Option Note Calculator, I've calculated a few scenarios again.

Three positives, one almost unchanged and one negative.

As you can see, the possibilities are again almost equally distributed in both directions. This is partly due to the fact that in all cases the warrant is still "in the money", i.e. it does not expire worthless. But even that are only clues. The maximum loss is a maximum of €95.04 (total loss). All-In, then.

Current status in the warrant depot

Open positions

54 x Call on Bechtle 16.12.2020, Strike 80 , Entry course: 1.76 € . DE000HZ0F4F2

Take profit: €2.86

Price after cost: €97.15

Balance

€95.75 (-€4.25)

Closed positions

Call on RIB Software. Profit by cost: +€15.86

Realized gains/losses: +€15.86

Note: All winnings will go to the charity depot.

Wait and drink tea.

I think with this trade I will have to wait a little longer until I know where the journey is going. Quarterly figures are scheduled for the end of November.

So the next post in this series could be published a little later, but hopefully it also ends with a win.

In principle, no stop loss is provided for in this experiment, so the warrants will be held in case of doubt until shortly before the end of the runtime.

Why do I run an experiment whose expected value is 0?

Why not? Even at a pub evening or a visit to the cinema or my money tends to be less. I think I can afford this fun.

[the_ad id=”1996″]

What do you mean how many trades the warrant deposit survives before it goes bust?

Who is right gets the VIP status here in my blog.

Comment (1)

1churlish| September 2, 2022

1heinous